A B&O tax surcharge applies to certain activities in addition to the B&O tax rate. Surcharge Tax Rate . Select Advanced Computing Surcharge. 1. 1.22% Specified Financial Institutions 1.20% . 1. See the select advanced computing businesses webpage for more information. Recent Collections ($000) Fiscal Year Collections % Change % of All State

How To Start a Business in Washington: 8 Easy Steps – Shopify

In Washington, the gross receipts tax is called the business and occupation (B&O) tax. B&O is defined as a tax on “the value of products, the gross income of the business, or the gross proceeds of sales, as the case may be” (Wash. Rev. Code Sec. 35.102.030). Washington does not levy a corporate income tax, so the B&O tax serves as an

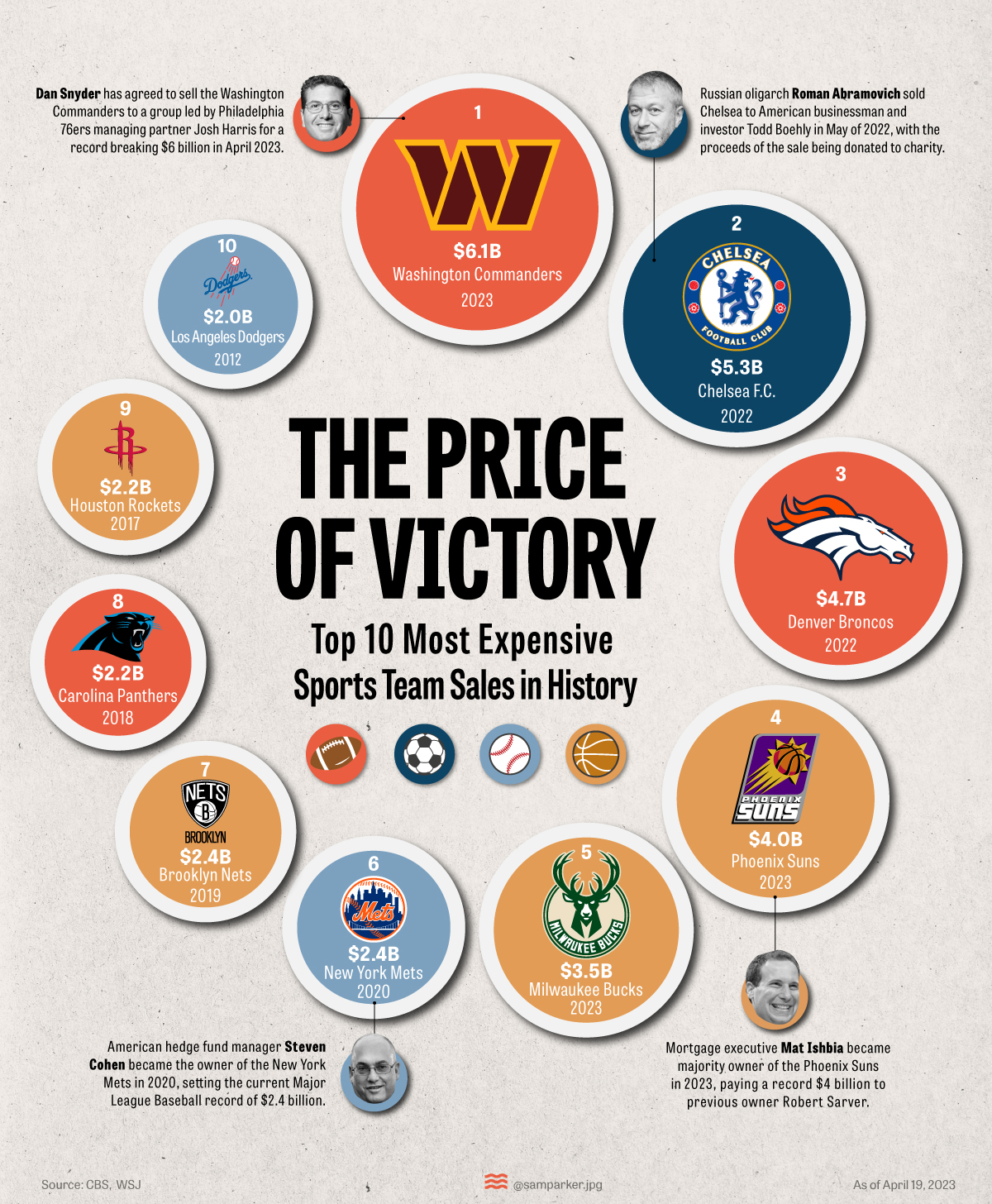

Source Image: visualcapitalist.com

Download Image

As your income goes up, you get a smaller and smaller credit, until you make enough to pay the full percentage. So, for example, if you pay Service/Other B & O annually, and your annual business income is $56,000, this gross income is tax-free. If you make $122,000 or more, you’ll pay the full 1.5%.

Source Image: patriotsoftware.com

Download Image

Washington Senators Look to Ban State Income Tax for Good Feb 3, 2023In Washington, the state sales tax rate is 6.5%, with some cities and counties adding additional sales tax. The B&O tax rate varies based on the type of business activity being conducted. Washington B&O Tax and Sales Tax are reported on the same tax return, the Combined Excise Tax Return. An area of confusion is whether a taxpayer should

Source Image: content.govdelivery.com

Download Image

Washington State B And O Tax Rate

Feb 3, 2023In Washington, the state sales tax rate is 6.5%, with some cities and counties adding additional sales tax. The B&O tax rate varies based on the type of business activity being conducted. Washington B&O Tax and Sales Tax are reported on the same tax return, the Combined Excise Tax Return. An area of confusion is whether a taxpayer should Aug 26, 2023The Business & Occupation tax is a unique tax system employed by the state of Washington to generate revenue from businesses operating within its borders. Unlike traditional income or sales taxes, the B&O tax is levied on the gross receipts of a business. Gross receipts encompass all forms of consideration, including sales, services, and other

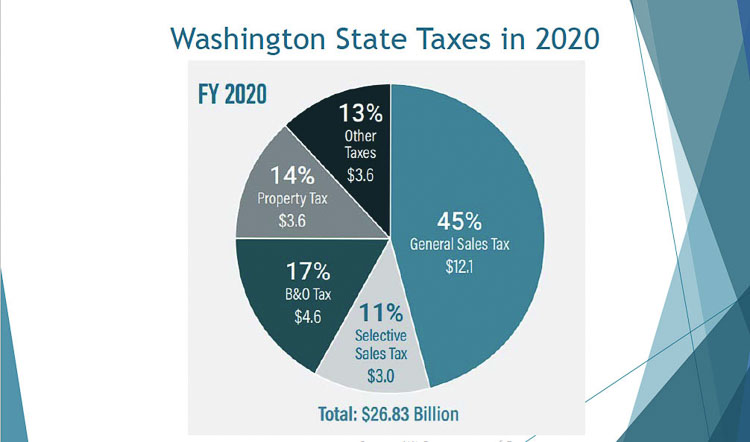

A closer look into the state operating budget

Jun 22, 2023Washington calculates B&O tax based on your gross income from business activities in the state. The tax rate varies by business classification. However, the majority of small businesses fall into the “service and other activities” category, which has a tax rate of 1.5% of gross receipts. You can’t take deductions from the B&O tax for When Are Washington State B&O Taxes Due in 2021?

Source Image: tldraccounting.com

Download Image

Supreme Court’s Roe Decision Forces Social Media Sites to Confront Misinformation Yet Again – Bloomberg Jun 22, 2023Washington calculates B&O tax based on your gross income from business activities in the state. The tax rate varies by business classification. However, the majority of small businesses fall into the “service and other activities” category, which has a tax rate of 1.5% of gross receipts. You can’t take deductions from the B&O tax for

Source Image: bloomberg.com

Download Image

How To Start a Business in Washington: 8 Easy Steps – Shopify A B&O tax surcharge applies to certain activities in addition to the B&O tax rate. Surcharge Tax Rate . Select Advanced Computing Surcharge. 1. 1.22% Specified Financial Institutions 1.20% . 1. See the select advanced computing businesses webpage for more information. Recent Collections ($000) Fiscal Year Collections % Change % of All State

Source Image: shopify.com

Download Image

Washington Senators Look to Ban State Income Tax for Good As your income goes up, you get a smaller and smaller credit, until you make enough to pay the full percentage. So, for example, if you pay Service/Other B & O annually, and your annual business income is $56,000, this gross income is tax-free. If you make $122,000 or more, you’ll pay the full 1.5%.

Source Image: spokanepublicradio.org

Download Image

Military Members and Spouses Could Avoid State Income Taxes Thanks to New Law | Military.com Businesses pay a Washington B&O tax rate depending on their classification. Washington B&O Tax Classifications. Classification: Tax Rate: Retailing.00471: Wholesaling.00484: Manufacturing … Small Business B&O Tax Credit. Washington State is considered one of the better tax states, in no small part because of its Small Business B&O Tax Credit.

Source Image: military.com

Download Image

State tax structure workgroup seeks input for possible changes to Washington tax system | ClarkCountyToday.com Feb 3, 2023In Washington, the state sales tax rate is 6.5%, with some cities and counties adding additional sales tax. The B&O tax rate varies based on the type of business activity being conducted. Washington B&O Tax and Sales Tax are reported on the same tax return, the Combined Excise Tax Return. An area of confusion is whether a taxpayer should

Source Image: clarkcountytoday.com

Download Image

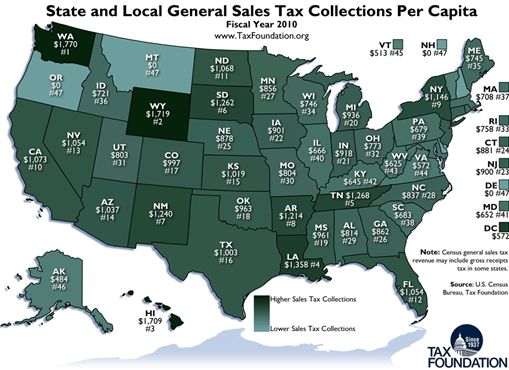

Monnette & Cawley, P.S. – Blog – Washington State: highest for per capita sales tax collections Aug 26, 2023The Business & Occupation tax is a unique tax system employed by the state of Washington to generate revenue from businesses operating within its borders. Unlike traditional income or sales taxes, the B&O tax is levied on the gross receipts of a business. Gross receipts encompass all forms of consideration, including sales, services, and other

Source Image: mrclaw.com

Download Image

Supreme Court’s Roe Decision Forces Social Media Sites to Confront Misinformation Yet Again – Bloomberg

Monnette & Cawley, P.S. – Blog – Washington State: highest for per capita sales tax collections In Washington, the gross receipts tax is called the business and occupation (B&O) tax. B&O is defined as a tax on “the value of products, the gross income of the business, or the gross proceeds of sales, as the case may be” (Wash. Rev. Code Sec. 35.102.030). Washington does not levy a corporate income tax, so the B&O tax serves as an

Washington Senators Look to Ban State Income Tax for Good State tax structure workgroup seeks input for possible changes to Washington tax system | ClarkCountyToday.com Businesses pay a Washington B&O tax rate depending on their classification. Washington B&O Tax Classifications. Classification: Tax Rate: Retailing.00471: Wholesaling.00484: Manufacturing … Small Business B&O Tax Credit. Washington State is considered one of the better tax states, in no small part because of its Small Business B&O Tax Credit.